-

×

- صفحه اصلی

-

خدمات

←

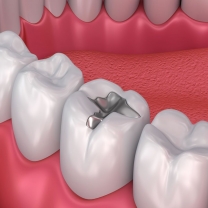

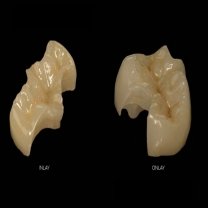

- خدمات ترمیم دندان

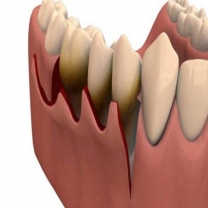

- خدمات تخصصی جراحی های لثه

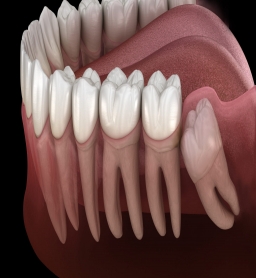

- خدمات جراحی های فک و صورت

- خدمات دندانپزشکی اطفال

- خدمات ارتودنسی

- خدمات زیبایی

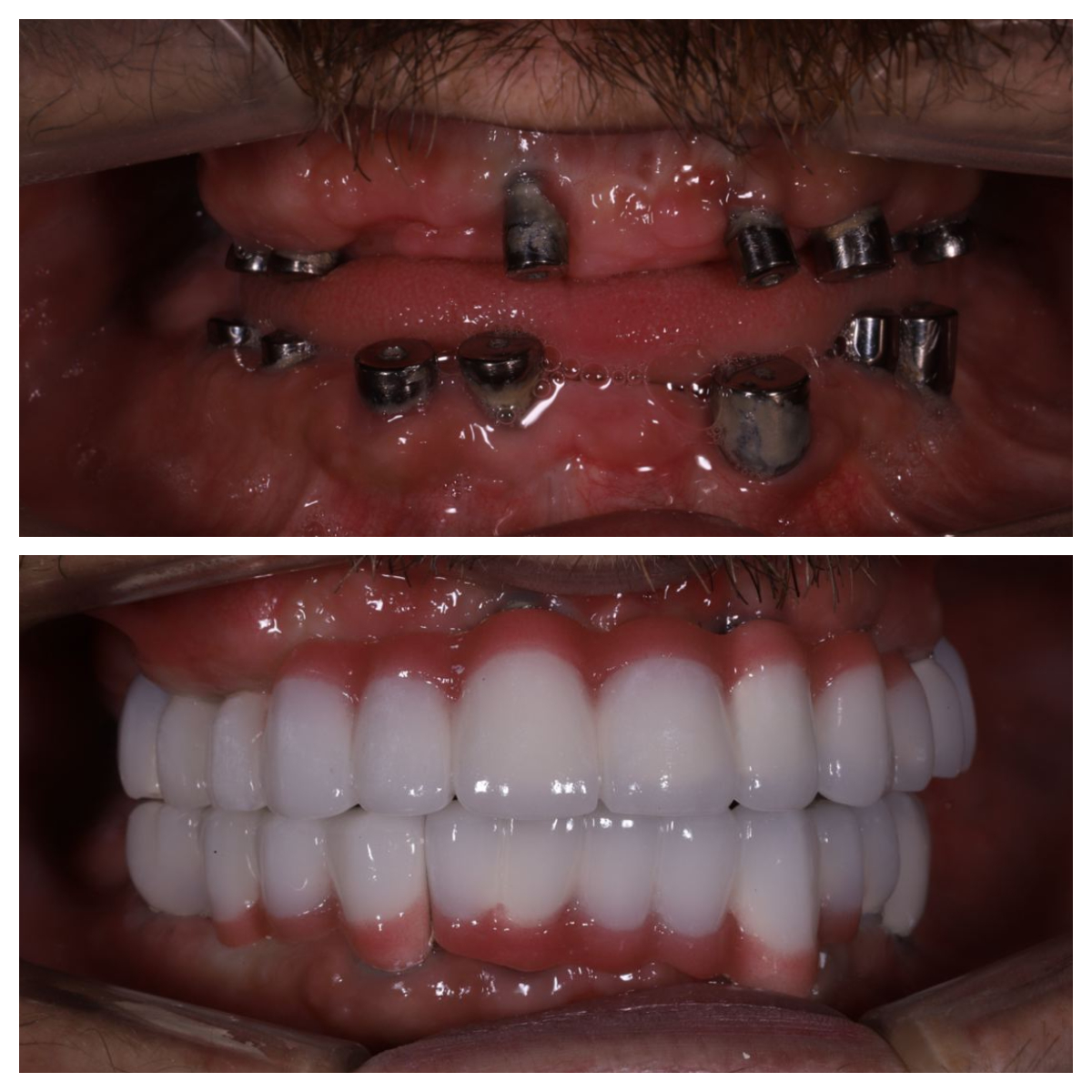

- خدمات ایمپلنت

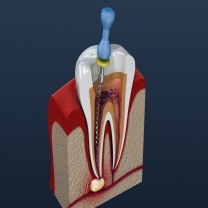

- خدمات درمان ریشه

- خدمات پروتز

- مراقبت های پس از درمان

- گالری تصاویر

- گواهینامه ها

- درباره ما

- تماس با ما

- دریافت عکس رادیولوژی

(خط ویژه)

02144101717